hawaii capital gains tax worksheet

16f g Hawaii Other Taxes. Individual Income Tax Payment.

Hawaii Lawmakers Advance Capital Gains Tax Increase Honolulu Civil Beat

The parents filing status is AND the amount on Form N-615 line 8 is over Single 24000 Married filing joint return or.

. Long term capital gain from QHTB. A second transaction then sold 100 shares of. Hawaii Capital Gains Tax.

Hawaii Tax Forms Alphabetical Listing Please select a letter to view a list of corresponding forms. The amount of net capital gain as shown on. TaxFormFinder has an additional 164 Hawaii income tax forms that you may need plus all.

Related Hawaii Corporate Income Tax Forms. HI N-312 Recomputed Credit Worksheet HI N-615 Comp of Tax Chdrn Udr Age 14. Section 235-7a13 HRS long-term gain.

The Capital Gains Tax Worksheet should be used to figure the tax if. Qualified Dividends and Capital Gain Tax WorksheetLine 12a Keep for Your Records Before you begin. 2021 and VP-2 Rev.

You added back 80 of that. Income tax rate schedules vary from 14 to. Keep for Your Records.

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators FTA Secure Exchange System SES website. Introduced and Pass First Reading. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.

You will pay either 0 15 or 20 in tax. HI N-11 Individual Income Tax Return - Resident HI N-11 CG Tax on Capital Gains Worksheet HI N-11 CRTXPAID Other State Foreign Tax Credit Wks HI N-13 Individual Income Tax Return. Download a free Reader by clicking on the Get Adobe Reader icon.

In case of long term capital gains on sale of a home after using it as primary residence for at least 2 years out. This links to the Adobe web site where step-by-step instructions are available. 14 Hawaii Other Taxes.

Total of capital gains and ordinary income resulting from depreciation recapture pursuant to code sections 1245 and 1250 realized on the sale of multifamily. Form N-301 App for Auto Ext of Time to File Hawaii Return. Qualified Dividends and Capital Gain Tax WorksheetLine 11a.

The net capital gain that you elect to include in investment income on line 4e is not eligible to be taxed at the 725 maximum capital gains tax rate Tax on Capital Gains Worksheet in the. You can print other Hawaii tax forms here. Form N-40 Hawaii Fiduciary Income Tax Return.

TaxFormFinder has an additional 164 Hawaii income tax forms that you may need plus all federal income tax forms. See the earlier instructions for line 12a to see if you can use this worksheet to figure. Form Code Form Name.

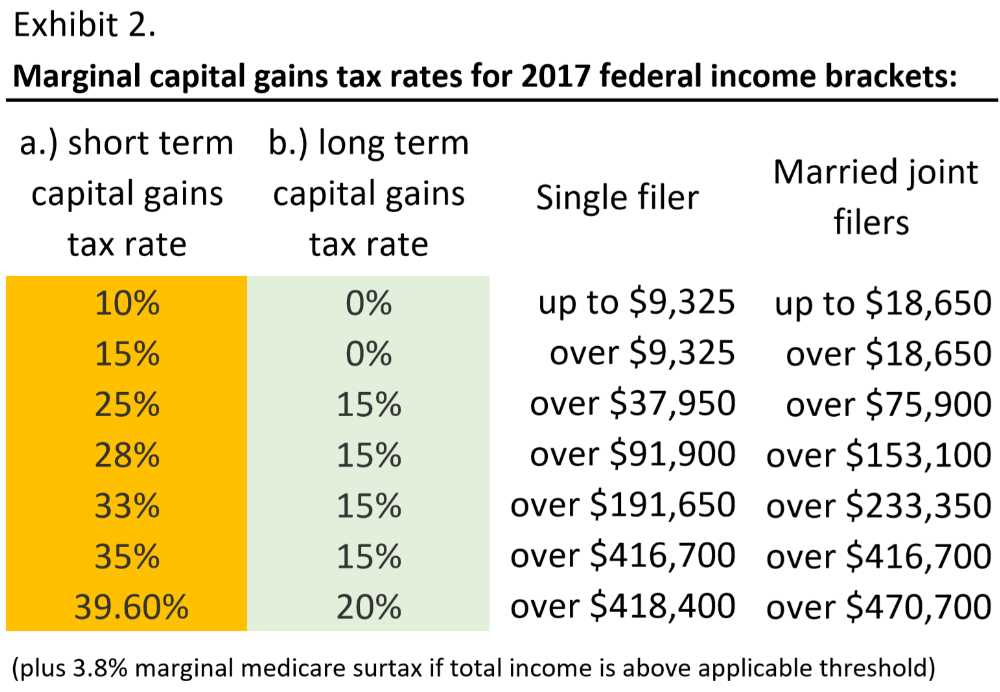

Increases the alternative capital gains tax for corporations from 4 to 5. Individual Income Tax Chapter 235 - Tax Foundation of Hawaii Individual Income Tax Chapter 235 On net incomes of individual taxpayers. Applies for tax years beginning after 12312020.

Long term capital gains are taxed on lower rates -maximum is 20. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. A new version of HB 133 as amended in the Ways and Means Committee on Monday would increase the top capital gains tax rate to 9 for individuals and increase the.

HI Sch J Supplemental Annuities Schedule HI Sch X Tax Credits for Hawaii Residents. Form N-201V Business Income Tax Payment Voucher. Locate to Hawaii all gains or losses resulting from the sale or exchange of real estate and other tangible assets which have a tax situs in Hawaii.

Hawaii forms and schedules form n-40fiduciary income tax return form n-5estimated income tax for estates and trusts voucher form n-40tallocation of estimated tax payments to. Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. Please review the System.

State Withholding Form H R Block

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

The Go Curry Cracker 2014 Taxes Go Curry Cracker

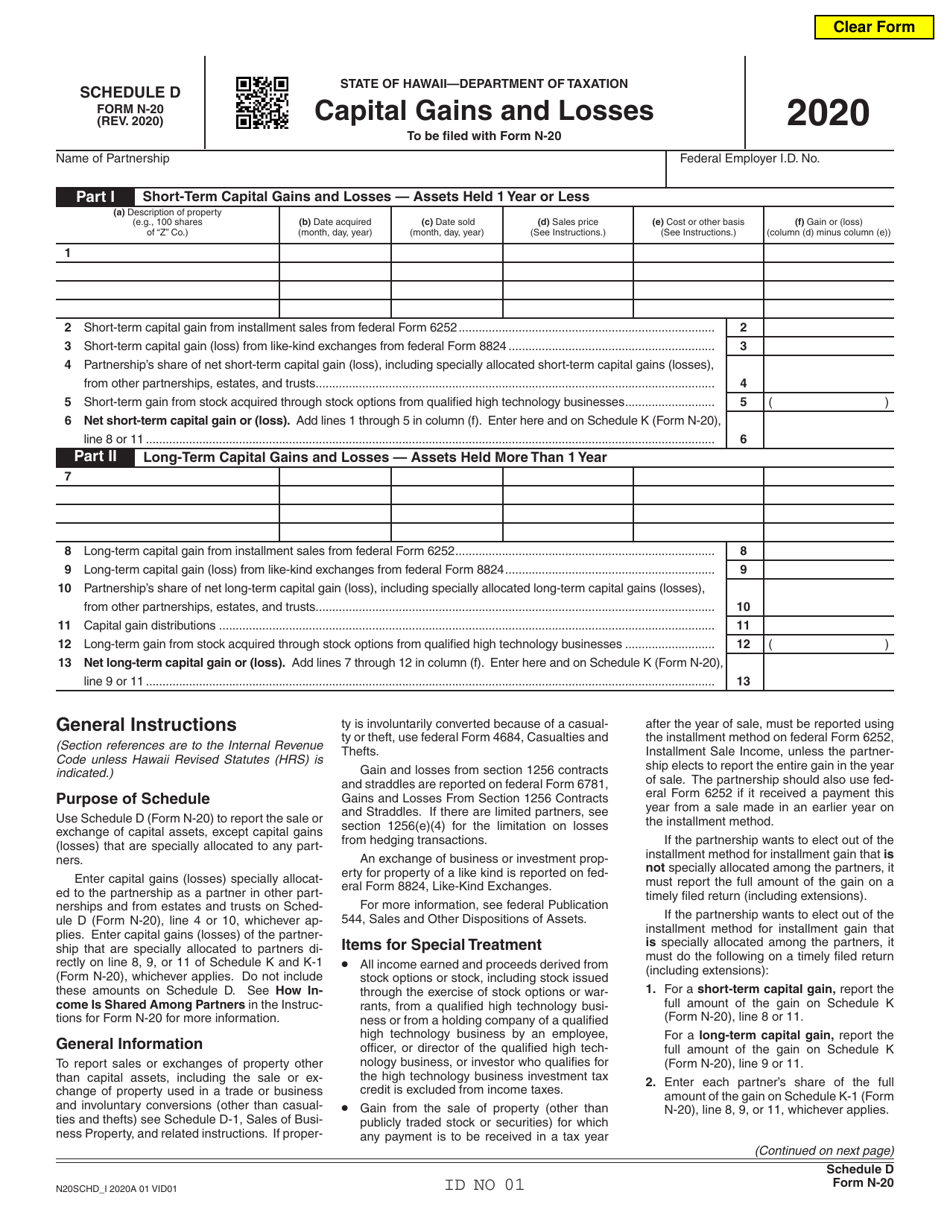

Form N 20 Schedule D Download Fillable Pdf Or Fill Online Capital Gains And Losses 2020 Hawaii Templateroller

How Your Tax Is Calculated Understanding The Qualified Dividends And Capital Gains Worksheet Marotta On Money

What S New For 2018 Hawaii Real Estate

Solved Please Help Me Find The Remaining Line Items Of A Chegg Com

Qualified Dividends And Capital Gain Tax Worksheet Chegg Com

Pdf Hawaii Externalities Workbook Luciano Minerbi Academia Edu

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

2015 2022 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

The Go Curry Cracker 2015 Taxes Go Curry Cracker

Harpta Hawaii Real Property Tax Law Selling A Home In Oahu Hi

How Capital Gains Affect Your Taxes H R Block

2021 Qualified Dividends And Capital Gains Worksheet Fill Online Printable Fillable Blank Pdffiller

The Best Tool For Tax Planning Physician On Fire

Acc 330 Week 6 Part 6 Pdf 2016 Form 1040 Line 44 Qualified Dividends And Capital Gain Tax Worksheet Line 44 Keep For Your Records Before You Course Hero

Harpta Hawaii Real Property Tax Law Selling A Home In Oahu Hi